Solidarity tax

If you're confused about the solidarity tax, you're not alone. In this section we'll help you understand how much you should pay and why.

All information is without guarantee of correctness and completeness and does not represent tax or legal advice.

You have a website of your own and would like to integrate our calculator as a widget? Go ahead and drop us a line via kontakt@steuerberater.com.

Basic Facts —

What is Solidarity Tax?

The solidarity tax [Solidaritätszuschlag] is raised as an additional tax to support unification of Germany - it is supposed to back economic development in the former Eastern German federal states. Initially it was introduced in 1991 to cover “additional financial burdens” caused by the Second Gulf War, support “the countries in Middle-, Easter-, and Southern Europe” and to finance “upcoming tasks in the former GDR federal states in East Germany”.

Numbers —

All taxpayers are subjected to pay 5.5% of their respective income tax rate [Einkommenssteuer]. For instance, if your personal income tax rate is 30% - the solidarity tax is 5.5% from 30%, making it 1.65% of your income. That means your personal income tax rate including solidarity tax is actually 31.65%. Taxpayers who pay less than €972 (single) or €1,944 (married couple) personal income tax per year are exempt from the solidarity tax. For personal income tax-payments up to €1,340 (single) or €2,680 (married couple) per year a reduced rate applies. For all payments above €1,340 or 2,680 per year, the rate is 5.5%.

972 €

If you earn below this amount per month, the solidarity tax doesn't apply to you.

5.5%

If your income tax is €1,340 or more, this is how much the solidarity tax will be.

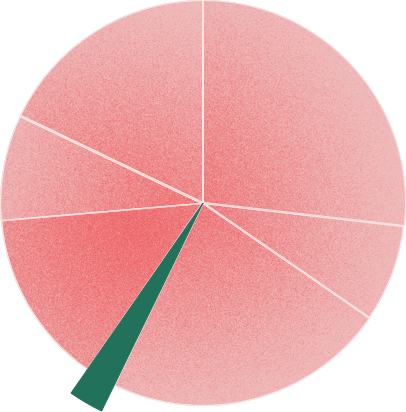

Tax income in Germany, 2018

Solidarity Tax

2.4%

The Controversy —

The solidarity tax has been and still is subject of political discussions. The German Taxpayers' Association for instance, has repeatedly questioned the constitutionality of the tax. In 2010, however, the German Federal Constitutional Court dismissed a lawsuit against the solidarity tax - so the tax is still raised. What many are not aware of, is that the solidarity tax is not earmarked. This means, the German government can spend the money on any public expenses. The whole discussion about the solidarity tax is lead by political arguments rather than by facts. On one hand people demand its abolition, because 30 years after German reunification it is no longer politically justifiable. Moreover, the fact that the Government is not obliged to use the revenues from the tax to finance the Eastern German federal states is criticized. It is also said to be unfair, because it is predominantly at the expense of high-income earners.

On the other hand people claim the abolition of the solidarity tax would only profit high-income earners, while low- and middle-income earners wouldn’t benefit from it. Furthermore, it is not clear if and how the missing €15 billion+ in the federal budget could be compensated.

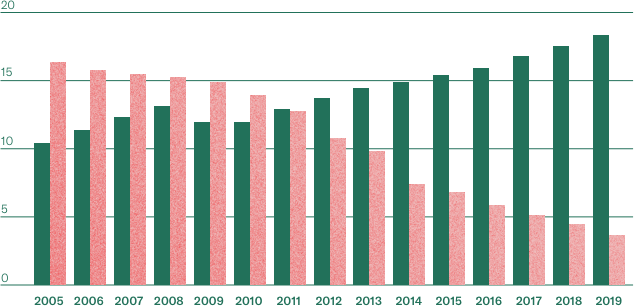

Solidarity tax distribution

In Billions of EUR

The Future —

Initially, the solidarity tax should have been raised only for one year, then until 1999. However, it was repeatedly extended by the federal governments - until today. The present government now agreed on reducing the tax. As of 2021 90% of the taxpayers shall be relieved from the solidarity tax. Further 6.5% will have a reduced tax rate. Only for the remaining 3.5% of taxpayers the full rate of 5.5% will still apply.

In numbers: annual incomes up to €73,874 will be exempt from solidarity tax. Between €73,875 and €109,451 a reduced tax rate applies. Only for annual incomes from/above €109,452 full 5.5% solidarity tax will still apply. The tax-reduction will cost the government €12 billion+.